By Octávio Aronis, Attorney

In my daily work, one of the challenges I must navigate is the negotiation of long-term payment settlements for clients outside of Brazil. Although coming to an agreement with the two parties involved is one aspect, maintaining a viable arrangement amidst unpredictable economic fluctuations is another, which requires careful and creative planning.

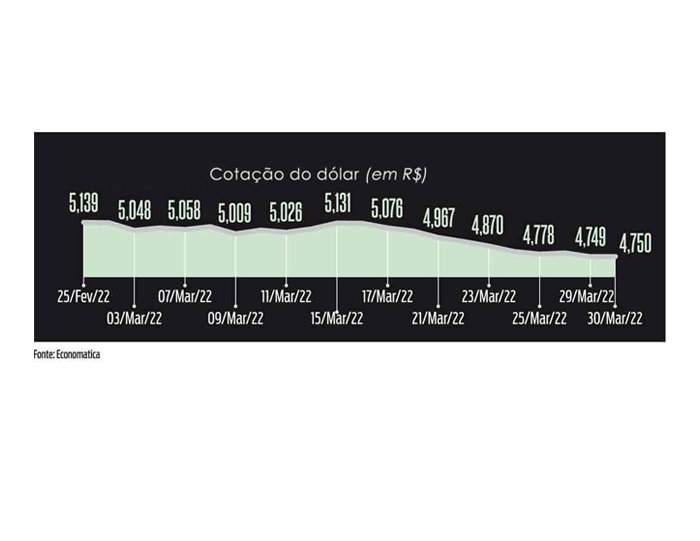

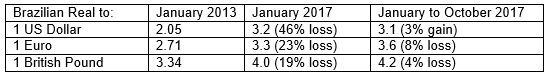

When I am arranging payment on behalf of my foreign clients, I must be aware of the exchange rate between the Brazilian Real and the currency of my clients’ countries.All currencies gain and lose strength regularly but the recent history of the Brazilian economy has made these fluctuations more pronounced and harder to predict. For example, from 2013 to 2017 the Real has decreased against one US dollar from 2.042 to 3.164, a 43% adjustment, and has shifted further just from January to the present.

Exchange Rate Variance History in Brazil (Numbers Approximate)

When payment is being arranged over this time period, the variance must be planned for in the agreement between the parties.

I should note that while payment over more than one year is not always the ideal solution, it can certainly be the preferable option in Brazil. When faced with the choice of litigation or a long-term settlement, many choose the latter because processing a claim through our courts can take as long as five years, at significant upfront cost, and with no guarantee of payment. When this is the case, accepting payments over multiple years seems to be the best resolution.

But simply agreeing to a regular payment amount and time frame is not sufficient when you expect to see a change in the exchange rate over the course of the payoff period. For example, if the Real falls in comparison to the US dollar, the debtor must use more Reals to maintain the installments, and depending upon the continuing devaluation, this may force the debtor to stop the installments.

Therefore, in anticipation of these fluctuations in agreements, I often need to build in flexibility so that both parties are satisfied in that as much as possible, payments will continue. For instance, if the Real weakens against the US dollar by over 20% over a period of six months, the debtor will be allowed to pay an agreed upon predetermined smaller amount in the foreign currency with an extended time frame. Conversely, if the Real gains over six months by over 20%, which does happen from time to time, then the payment amounts will increase along with a shorter time frame.

I have found this approach to be an equitable and pre-emptive way to prepare my client and the debtor for the unavoidable fluctuations that may occur. It also means:

- Avoiding renegotiation with the debtor each time the rate significantly changes

- Not needing to seek repeated approvals from the client

- Saving time to draw up and obtain confirmation on new agreements

- Minimizing the risk that the debtor may default on a long term payment plan

In addition to minimizing the impact of exchange rate fluctuations, the agreements are created such that:

- Payments are pegged to strong currencies such as the US Dollar, Euro, or British Pound

- Interest may also be charged, especially when installments and payment terms become smaller and longer respectively

- As a Confession of Indebtedness, signed by both parties, they are an enforceable document upon default

- Wire transfer fees are borne by the debtor

Exchange rates are a reality that must be dealt with anytime a long-term settlement is being negotiated for a foreign client. However, by being proactive and anticipate what may transpire down the road, we are able to support the continuity and flexibility of the payment plan, not only to reach the final “paid in full” result but to also maintain a semblance of the relationship between the two parties as well.

For any questions or comments about this article or our services, please contact me at octavio@aronisadvogados.com.br.

This article has been edited by Ed Bessenbacher of Stellar Risk Management Services, Inc. All Rights Reserved.